Hi I used chatgpt to give me difference

Here’s a breakdown of the differences between GannTrader (via Optuma) and Optuma more generally, to help you understand which might suit your workflow better.

---

What each product is

Optuma:

A full-featured technical analysis platform intended for traders, analysts & institutions.

Supports multiple asset classes, unlimited charts (in many plans), custom scripting, advanced chart types, scanning & alerts.

Has several pricing tiers: Trader, Professional, Enterprise.

GannTrader:

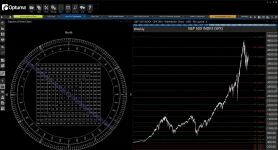

This is essentially a specialised edition/module built on the Optuma platform, geared toward the work of W.D. Gann-style analysis (cycles, Gann squares, time/price geometry, astro tools).

Pricing: For example GannLite = US$3,595 (12 months) and GannTrader full = US$5,995 (12 months) for the licence + data + support.

It includes a set of “Gann tools & charts” and extras like ephemeris, natal charts, planetary angles etc for what they call “financial astrology” aspects.

---

Key Differences

Here are the main points you’ll want to compare:

Feature Optuma (General) GannTrader Edition

Scope Broad technical & quantitative analysis across asset classes, many chart types, scripts, scanning, alerts. Focused heavily on Gann-based tools (Square of 9, time/price cycles, astro tools) built on the Optuma engine.

Pricing Lower entry (e.g., Optuma Trader ~ US$810/year for basic plan) according to published pricing. Higher cost — reflects niche/specialised Gann-module + extra tools + support. E.g., US$3,595+ for GannLite package.

Included Tools Standard charts/indicators + powerful scripting, scanning, multiple securities. Includes many extra “Gann / Astro” tools: Gann Fans, Hexagon, Square of 9, planetary angles etc.

Data / Service Model Subscription model: Software + data + support; renewal needed for data & updates. Similar model but with premium price and specialised service; renewal required for data & modules.

Use Cases If you are analysing markets, many securities, building scans, quantitative models, multi-asset, want flexibility. If your strategy is specifically Gann-style (time/price geometry, cycles, astro) and you want those dedicated features.

---

Which should you pick (given your context)

Given that you’re interested in things like the “AlgoCados Anchored Square of 9” indicator (Gann-style), here are thoughts:

If you primarily want to specialise in Gann/cycle/astro analysis (like you studying) → GannTrader might be a very strong fit because it gives you the dedicated tools for that domain.

If you also want wider coverage: multi-asset, scanning, quantitative workflows, broader charting and not solely Gann-tools → then the general Optuma platform may give you more flexibility and perhaps cost-effectively.

Another aspect: consider budget, data access (end-of-day vs real-time, number of exchanges), support, learning curve (Gann tools have steep learning).

Because you want to publish a TradingView indicator and maybe an intraday version — if your strategy will interface or integrate with GannSquare of 9 logic then using the Gann specific features could shorten your development time.

---

My recommendation for you

Given your interest (you are studying how to replicate an AlgoCados Anchored Square of 9 indicator based on Gann), I would recommend:

Start with the Optuma general platform (if budget allows) to get comfortable with the charting, scripting, data import/export, multi-timeframe etc.

Then evaluate the GannTrader module add-on: if you find you need the advanced Gann/Astro tools you’ll benefit from it.

Check the interoperability with your workflow (for example: can you import/export from/to TradingView? Can you script the Gann modules you need?).

Also check the renewal costs: after initial year you’ll have continuing subscription / data costs.

Consider if you need intraday (tick/intra-day) or just end-of-day (EOD) data; these platforms often vary materially there.

---

If you like, I can pull up a full feature-comparison document between Optuma basic vs GannTrader edition (with a table of specific tools each includes), and pricing for the UAE / Middle East region (since you’re in Dubai) to see if there are regional differences. Would that be useful?

@brownman what's the difference between this and optuma?