Mastering Backtesting for Algorithmic Trading

Unlock the Power of Historical Simulations – First Principles to Advanced

Requirements

- Familiarity with Python programming

- Basic understanding of financial markets and trading.

- Linear algebra and statistics is helpful

- Ability to read mathematical equations

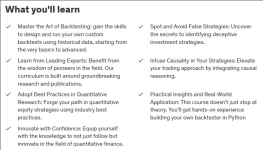

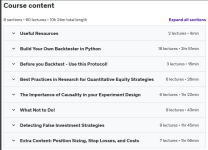

Building Your Own Backtester in Python: Dive into the technicalities of building a backtester from scratch. Learn to code in Python and use popular libraries to create a versatile and reusable backtesting framework.

Before You Backtest - Use This Protocol!: Understand the essential steps to prepare for backtesting. This module focuses on data collection, hypothesis formation, and setting up testing parameters.

Best Practices in Research for Quantitative Equity Strategies: Learn the industry-standard research methodologies that quantitative analysts use for developing equity strategies. We cover data analysis techniques, statistical tests, and more.

The Importance of Causality in Your Experiment Design: Understand the role of causality in trading strategy design. Learn how to differentiate between correlation and causation to build more effective trading strategies.

What Not to Do!: A critical look at common pitfalls in strategy backtesting. Learn to identify and avoid mistakes that can lead to inaccurate conclusions and poor strategy performance.

Detecting False Investment Strategies: Equip yourself with the knowledge to spot and avoid strategies that appear profitable but are actually flawed due to overfitting, data-snooping biases, or other errors.

Bonus Lectures: Engage with additional content that delves into advanced topics, real-world case studies, and emerging trends in quantitative finance.

Code:

https://www.udemy.com/course/mastering-backtesting-for-algorithmic-trading/